Homeowners Insurance in and around Indian Head

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

When you’ve worked a long shift, there’s nothing better than coming home. Home is where you recharge, wind down and catch your breath. It’s where you build a life with family and friends.

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Open The Door To The Right Homeowners Insurance For You

Dave Dixon can walk you through the whole coverage process, step by step. You can have a straightforward experience to get an insurance policy for everything that’s meaningful to you. We’re talking about more than just protection for your electronics, appliances and swing sets. Protect your family keepsakes—like souvenirs and collectibles. Protect your hobbies and interests—like musical instruments and sports equipment. And Agent Dave Dixon can share more information about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or have home security devices, and there are plenty of policy inclusions, such as liability insurance to protect you from covered claims and legal suits.

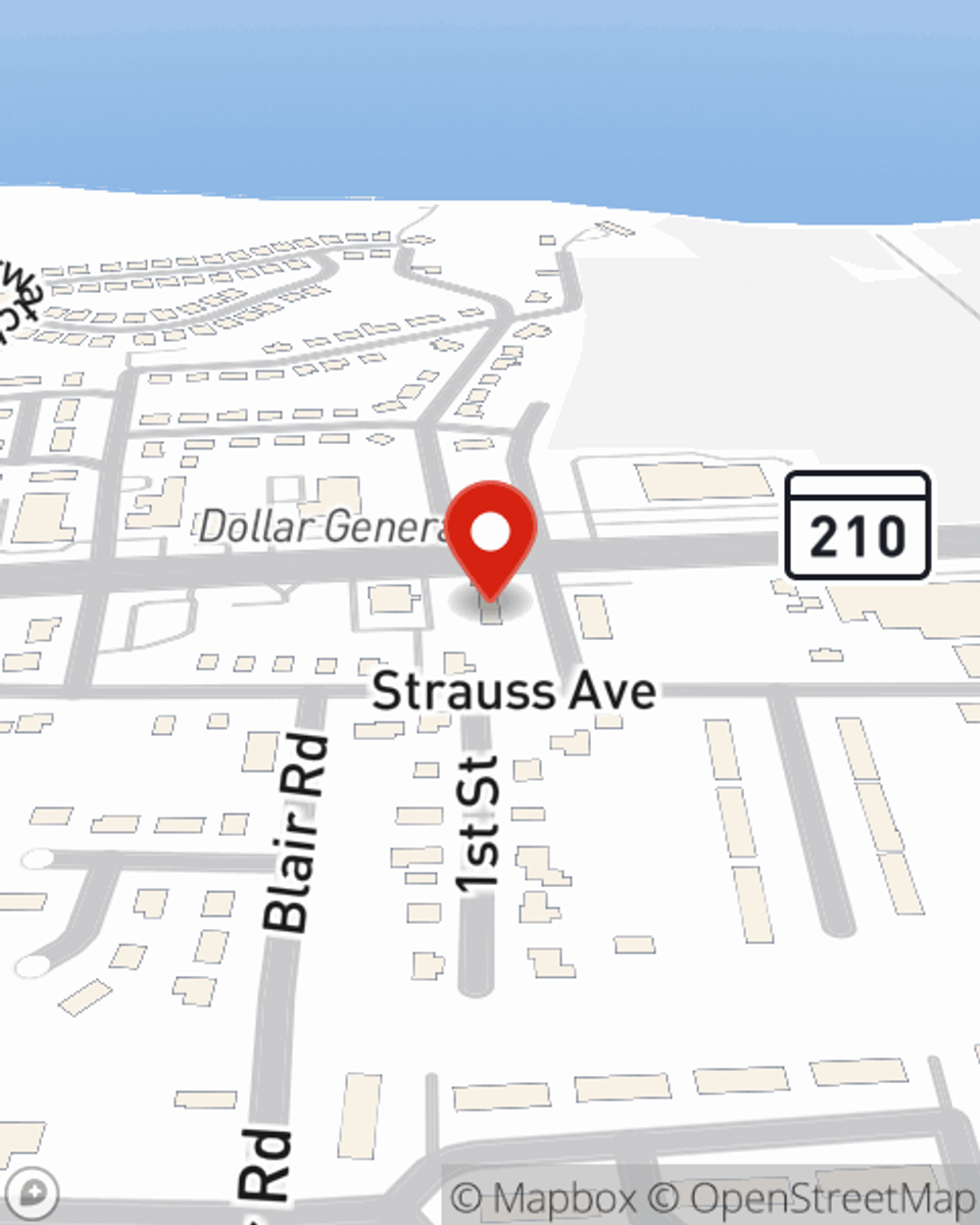

When your Indian Head, MD, residence is insured by State Farm, even if the worst comes to pass, your home may be covered! Call or go online now and find out how State Farm agent Dave Dixon can help you protect your home.

Have More Questions About Homeowners Insurance?

Call Dave at (301) 743-7200 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

Simple Insights®

Signing a lease: What you need to know

Signing a lease: What you need to know

When signing a lease, it’s important to prepare, understand your lease agreement, and ask the right questions of your landlord.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.